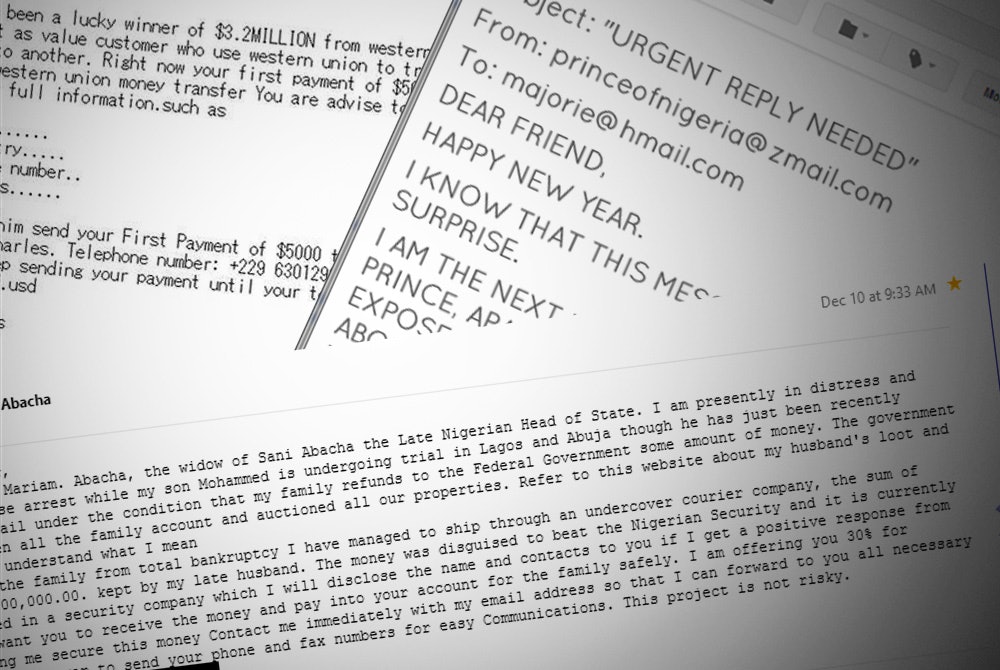

Have you ever received an email promising untold riches, perhaps from a Nigerian prince, with a simple request for your assistance? If so, you've likely encountered a "Nigerian Prince Scam," a pervasive form of online fraud that continues to ensnare unsuspecting individuals despite its well-documented history.

The digital landscape is littered with tales of these elaborate schemes, each iteration designed to exploit human trust and greed. These scams, often originating from across the globe and not solely Nigeria, predate the internet, evolving from postal mail to emails and now incorporating various modern communication methods. These cons, also known as "419 scams" (named after the section of Nigeria's criminal code dealing with fraud), are notorious for their ability to manipulate victims, sometimes leading to substantial financial losses and personal distress.

Let's delve into the nuances of this deceptive tactic, examining its origins, evolution, and the psychological principles that make it so effective. We'll also explore the warning signs and protective measures necessary to avoid becoming the next victim.

- Alex Riley Wwe Career Nxt And Beyond Latest News Updates

- Andrs Gmez Tennis Legend More Career Stats Facts

Understanding the Nigerian Prince Scam

The Nigerian Prince scam, at its core, is a form of "advance-fee fraud." The premise is simple: a scammer, posing as a wealthy individual, often a Nigerian prince, a business magnate, or a government official, contacts a potential victim with an enticing offer. The promise? A large sum of money in exchange for a seemingly small favor.

The "favor" usually involves helping the scammer transfer funds out of Nigeria, often under the pretense of escaping political unrest, accessing a frozen inheritance, or circumventing bureaucratic hurdles. To facilitate this transfer, the victim is asked to provide personal information, such as bank account details, and to make various advance payments to cover processing fees, legal expenses, or taxes. These fees, of course, disappear into the scammer's pockets.

The stories spun by the scammers are often elaborate and compelling, designed to build trust and create a sense of urgency. They might involve tales of political persecution, frozen assets, or secret space missions (as absurd as it sounds). The goal is to hook the victim, drawing them deeper into the scheme and extracting ever-increasing amounts of money.

- Kameron Michaels Return Of The Rpdr Star Where To Find Her

- Understanding Coy Meaning Synonyms Usage A Complete Guide

The success of these scams isn't solely due to their elaborate narratives. They also exploit several psychological vulnerabilities, most notably the "sunk cost fallacy." This cognitive bias leads individuals to continue investing in a losing proposition because they've already invested time, effort, or money. The more they've put in, the harder it becomes to walk away, even when faced with overwhelming evidence of fraud.

The Anatomy of a Scam

Despite their deceptive nature, Nigerian Prince scams share several common characteristics that can help potential victims identify them. Being aware of these "red flags" can significantly reduce the risk of falling prey to these schemes.

- Unsolicited Contact: The initial contact is almost always unsolicited, often arriving via email, text message, or social media. You haven't expressed interest in receiving money, and the offer comes "out of the blue."

- Promises of Unrealistic Riches: The sums of money being offered are typically exorbitant and unrealistic. No legitimate financial institution or individual would offer such a large payout for minimal effort.

- Vague or Implausible Storylines: The stories told by scammers are often convoluted and implausible, involving foreign royalty, deceased relatives, or complicated legal situations.

- Requests for Personal Information: Scammers will always ask for personal information, including bank account details, Social Security numbers, or other sensitive data. They need this information to access your money.

- Demands for Advance Payments: The most crucial warning sign is a demand for upfront payments. Legitimate transactions never require you to pay money to receive money.

- Use of Poor Grammar and Spelling: While some scammers are more sophisticated, many use poor grammar, spelling errors, and awkward phrasing, a result of language barrier.

- Pressure Tactics and Urgency: Scammers often create a sense of urgency, pressuring victims to act quickly to prevent them from thinking through the situation carefully.

Protecting Yourself from the Scam

Avoiding the Nigerian Prince scam requires a proactive approach, including healthy skepticism and awareness of the tactics used by fraudsters. Here's how to protect yourself:

- Be Skeptical of Unsolicited Offers: Never trust emails, messages, or calls offering you large sums of money, especially if you don't know the sender.

- Never Share Personal Information: Do not provide your bank account details, social security number, or any other sensitive information to unknown parties.

- Never Make Advance Payments: No legitimate transaction requires you to pay money to receive money.

- Verify Information Independently: If you receive an offer that seems legitimate, conduct independent research. Verify the sender's identity, investigate the company or organization involved, and consult with trusted financial advisors.

- Be Wary of Emotional Manipulation: Scammers often use emotional appeals to build trust and create a sense of urgency. Don't let emotions cloud your judgment.

- Report Suspicious Activity: Report any suspicious emails, calls, or messages to the Federal Trade Commission (FTC), the Internet Crime Complaint Center (IC3), or your local law enforcement agency.

- Use Strong Passwords and Secure Your Accounts: Regularly update your passwords and enable two-factor authentication on all your online accounts.

- Keep Your Software Updated: Ensure your computer's operating system, antivirus software, and other programs are up-to-date to protect against malware and other cyber threats.

The Evolution of the Scam and the Modern Threat

The Nigerian Prince scam has undergone significant evolution over the years. Scammers constantly adapt their tactics to stay ahead of security measures and public awareness. While the classic email scam is still prevalent, fraudsters now use more sophisticated approaches.

These include:

- Phishing Emails: Scammers have become adept at creating phishing emails that mimic legitimate communications from banks, online services, and other organizations. These emails often contain links to fake websites designed to steal login credentials and personal information.

- Social Media Scams: Scammers use social media platforms to build relationships, gain trust, and target potential victims. They may create fake profiles, join groups, and engage in conversations to identify and exploit vulnerable individuals.

- Romance Scams: Scammers often create fake profiles on dating sites or social media and try to create relationships with potential victims.

- Investment Scams: Scammers may offer investment opportunities, promising high returns with little risk. These scams often involve fake companies, Ponzi schemes, or other fraudulent investment vehicles.

- Business Email Compromise (BEC): In this sophisticated scam, criminals hack into a business's email system to send fraudulent invoices or request wire transfers to their own accounts.

These evolving tactics underscore the importance of staying informed about the latest threats and taking proactive steps to protect yourself. Phishing remains a significant threat, as emails are the primary source of these attacks. Cultivating a healthy level of skepticism when receiving any type of digital communication is essential.

The "Sunk Cost Fallacy" and Why Scams Persist

The Nigerian Prince scam's continued success hinges on the "sunk cost fallacy," a psychological principle. This fallacy explains why individuals might stay in a losing situation because they've already invested time, effort, or money. The more victims invest, the harder it becomes for them to accept they've been conned. The desire to "recoup" their losses overrides their judgment, leading them to make further payments and share even more personal information.

This phenomenon also plays into the scammers' hands, as they understand how to manipulate victims by creating a sense of false hope and investment. They often use this to their advantage, promising a reward after each payment, making the victim feel like they are on the verge of success.

The Global Reach of the Nigerian Prince Scam

While the term "Nigerian Prince" suggests a geographic origin, the reality is more nuanced. The scammers operate globally, using internet technologies to reach a vast audience. The term is often used to draw in victims and add a layer of complexity to the story. While Nigeria was an early point of origin for these scams, fraudulent messages now originate from around the world, attempting to trick people with the lure of free money.

The stories associated with these scams also reflect the globalized nature of fraud, often referencing contemporary events, popular trends, and cultural references to increase their appeal. The themes of these phishing emails have evolved over time, with cybercriminals leveraging these to pique the interest of their targets.

Conclusion

The Nigerian Prince scam is a persistent threat that has adapted to the modern digital landscape. By understanding its origins, recognizing the red flags, and taking steps to protect yourself, you can avoid falling victim to these fraudulent schemes. Remember, if it seems too good to be true, it probably is. And if you're asked to pay money to receive money, it's almost certainly a scam. Stay vigilant, stay informed, and protect yourself from the allure of unrealistic promises.